06 May, 2025

Search by community

New off-plan developments

Why choose us ?

No obligation market appraisal for your

property today.

Our virtual options are

still available if you prefer

Years of Business

Business deals

Client Satisfaction Rate

Happy Clients Served

Top Developers in UAE

Thousands of luxury home enthusiasts just like you visit our website.

Clients Testimonials

Thousands of luxury home enthusiasts just like you visit our website.

Top Agents of the Week

A dedicated team of innovators, collaborating with passion and precision to deliver excellence.

Explore Property agents are here to help with all your

buying, renting and selling goals.

Find the home of your dreams with an expert you can trust. Let’s chat

Guides

Navigating the world of property transactions can feel overwhelming, but with the right guidance.

Whether you're buying your dream home or selling to move forward, understanding the process empowers you to make informed decisions.

This guide will walk you through every step, offering insights, strategies, and tips to maximize value and minimize stress

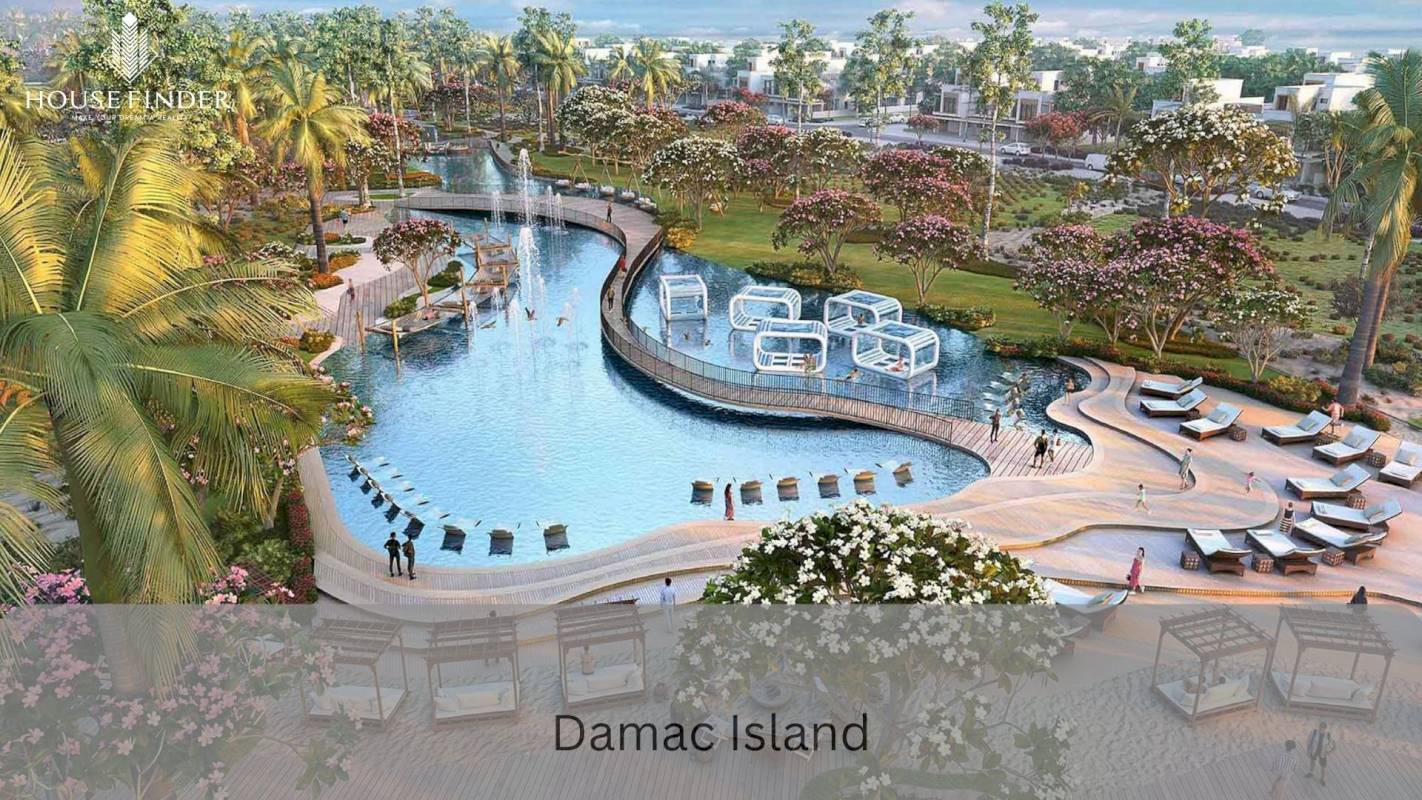

Trending Projects in Dubai

Discover Dubai's Hottest Real Estate Investments of the Year

Real Estate News

We are committed to building long-term relationships with our clients based on trust and integrity.

08 Apr, 2025 Housefinder Dubai

Global Crackdown on Foreign Property Buyers: Why Dubai Stands Out as the Last True Haven

Read More07 Apr, 2025 Housefinder Dubai

Why Every Rental Transaction Must Include a Commission Agreement

Read MoreBlogs

Thousands of luxury home enthusiasts just like you visit our website.

30 Mar, 2025 Housefinder

Major Developers Unveil Phase Two Of Manta Bay On Al Marjan Island

Read More30 Mar, 2025 Housefinder

WhatsApp

WhatsApp